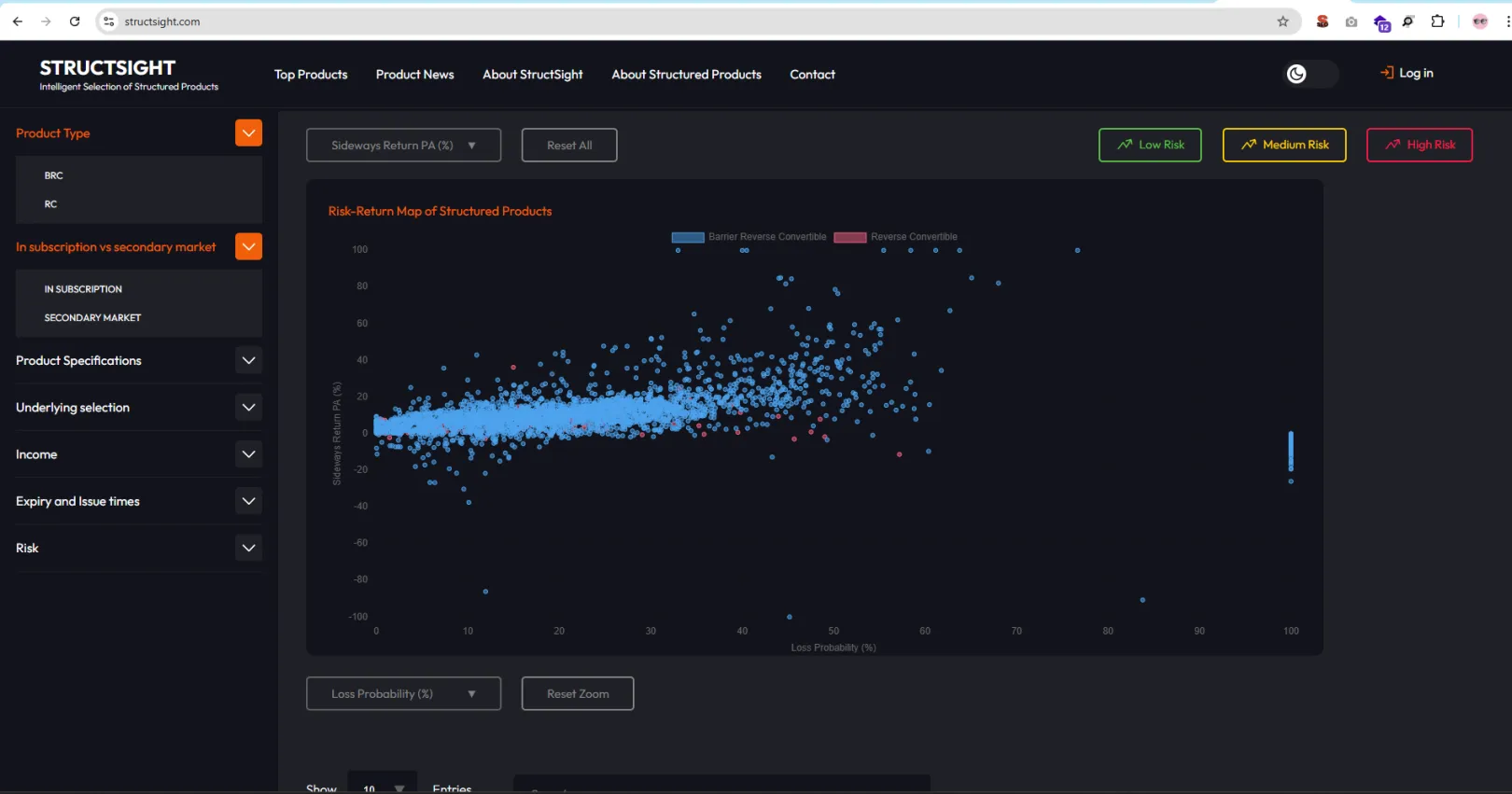

Structsight, a USA-based company specializing in structured yield and bespoke investment products, needed a robust and dynamic digital solution to track and display real-time market data for its investment products. Their structured products involve various asset classes such as equities, indices, funds, interest rates, currencies, commodities, and real estate, making it crucial to provide accurate, up-to-date financial insights to investors.

The project aimed to integrate live data feeds, optimize API performance, and create interactive visualizations that would help investors make informed decisions. Given the complexity of structured products and the need for real-time updates, the challenge was to ensure high-speed data retrieval, accuracy, and a seamless user experience.

The 6.6-week offshore development project resulted in a secure and responsive website that fetches live market data, displays it in an interactive Risk-Return Map, and provides a user-friendly table for easy comparison. The solution transformed how Structsight’s clients interact with investment data, offering a transparent, real-time, and visually engaging experience.

About the project

Goals

- Develop a secure, responsive, and user-friendly platform for investors.

- Integrate real-time data tracking for structured products.

- Optimize API calls to ensure fast, efficient, and accurate data retrieval.

- Create interactive and visually appealing performance graphs.

Requirements

- API integration for fetching live market data.

- Advanced synchronization between API and front-end for real-time updates.

- Dynamic graph representation to visualize structured product performance.

- Data filtering and navigation for easy product comparison.

- High-performance architecture capable of handling frequent updates without lag.

Outcome

- Successfully developed a website with real-time product tracking and dynamic graphs.

- The Risk-Return Map was implemented to provide transparency and assist investors in decision-making.

- Optimized data processing ensured fast and reliable market insights.

- The solution enhanced user engagement by providing an intuitive interface and clear financial data visualization.

By leveraging Drupal’s powerful API capabilities, the website now enables investors to monitor structured product performance seamlessly, ensuring data accuracy, speed, and usability in one comprehensive solution.

Back to topWhy Drupal was chosen

Drupal was selected due to its scalability, security, and flexibility in handling structured data. Its robust API-first approach made it the ideal choice for seamless integration with real-time market data feeds. Drupal’s modular architecture allowed for rapid customization, ensuring that the platform could efficiently process and display complex financial data in an intuitive format.

Back to top

Technical Specifications

Drupal version: