Sector(s)

Team Members

Project Team

Santander Uruguay shaped business needs and governance, collaborating with the Kadabra IT team—comprising project managers, developers, architects, testers, quality assurance specialists, designers, and user experience/user interface experts. The effort spanned eight months in 2023, exceeding 1,000 hours, with ongoing support for enhancements.

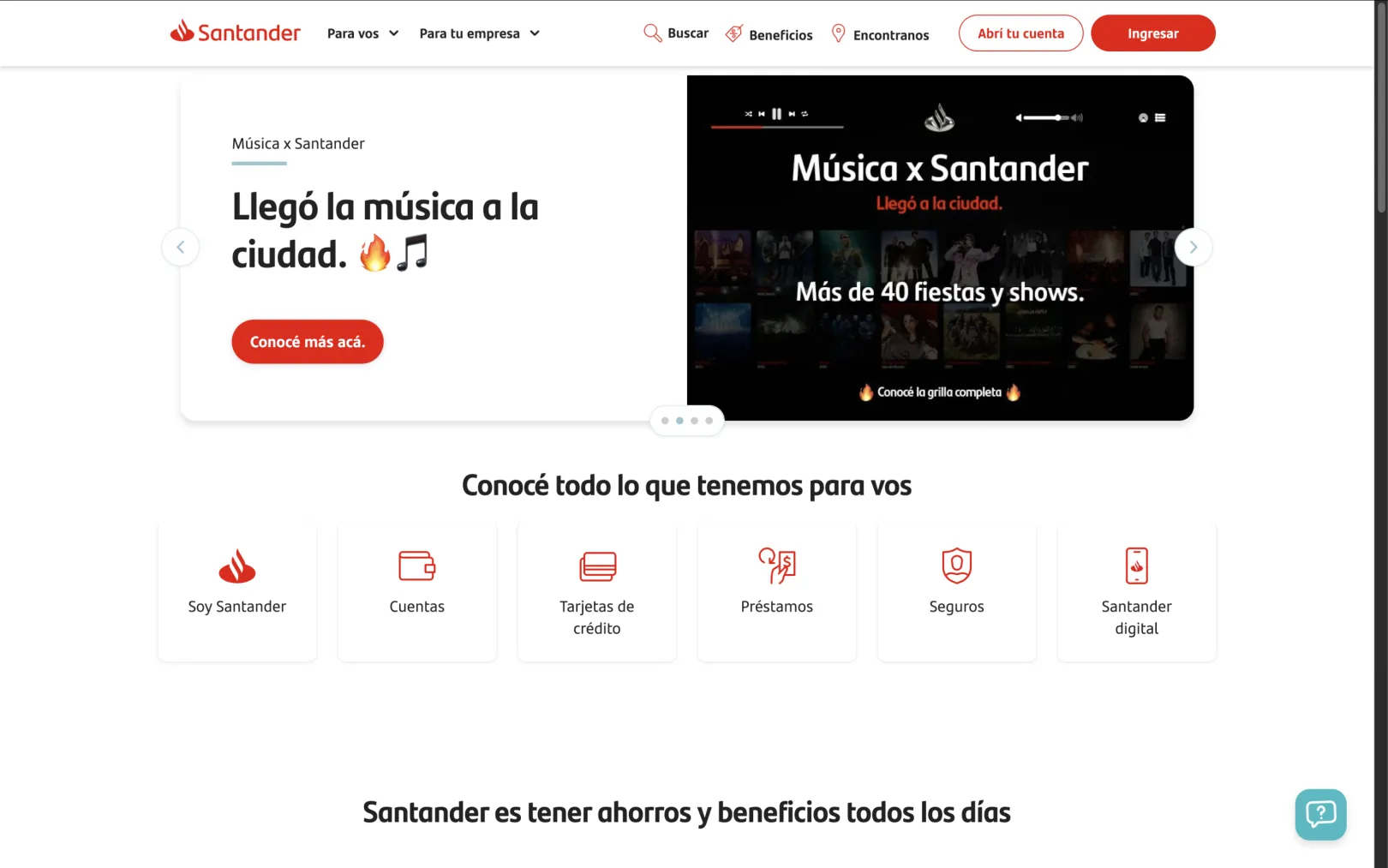

Santander Uruguay, the leading private bank in Uruguay, partnered to rebuild its institutional website using Drupal. The project tackled outdated performance issues and limited team autonomy by enhancing user experience, content management, and speed. Drupal's flexibility empowered internal teams to launch campaigns swiftly, integrate secure banking features, and drive digital growth—resulting in doubled conversions for new accounts, a surge in product leads, and the fastest site among Uruguayan banks.

About the project

Santander Uruguay's existing site suffered from slow loading times, confusing navigation, and cumbersome content updates on an outdated platform nearing end-of-support. High volumes of support queries burdened the contact center, and teams lacked autonomy for quick marketing experiments or governance clarity.

Goals

The goals centered on boosting performance, simplifying information architecture, enhancing accessibility, and streamlining workflows to empower editors. Requirements included seamless integration with private banking systems, reusable components for promotions, and self-service features like an improved Frequently Asked Questions (FAQ) section to cut queries.

Through a collaborative discovery phase involving stakeholder insights and user-focused design, the team restructured the site for intuitive navigation. Drupal's capabilities enabled drag-and-drop content building, advanced search for user guidance, and efficient media handling—all without heavy custom coding.

Outcome

Internal teams now publish updates in minutes, shifting 60% of account sales to digital channels and elevating the site to top speed rankings in Uruguay. Load times plummeted from 7 seconds to 2.5 seconds, accessibility scores climbed from 60 to 95, and customer satisfaction in digital tools rose 30%. This transformation not only reduced operational friction but also sparked innovative ways to engage users, proving Drupal's role in scalable, real-world impact.

- 30% increase in customer satisfaction for digital help center

- 80% of new accounts now from digital channels (doubled from pre-redesign)

- 60% increase in product leads

- 25% faster on desktop, 36% faster on mobile

Back to top"Drupal empowered our teams to innovate freely, turning challenges into opportunities for growth."

Why Drupal was chosen

Drupal stood out for its powerful tools that let non-technical teams manage content independently, while offering robust security and scalability ideal for financial services. Its open-source community ensures ongoing innovations without locking into proprietary systems, making it perfect for handling complex integrations like banking logins and reusable campaign elements. This choice overcame previous hurdles, fostering faster updates and better compliance with industry standards.

Technical Specifications

Drupal version:

These were selected to give content editors intuitive drag-and-drop interfaces for building pages, streamlined handling of images and videos, powerful search to guide users effectively, and easy creation of interactive forms. They focused on reusability and maintenance, supporting a centralized multisite setup while keeping things simple for the bank's teams to adapt without developer help.